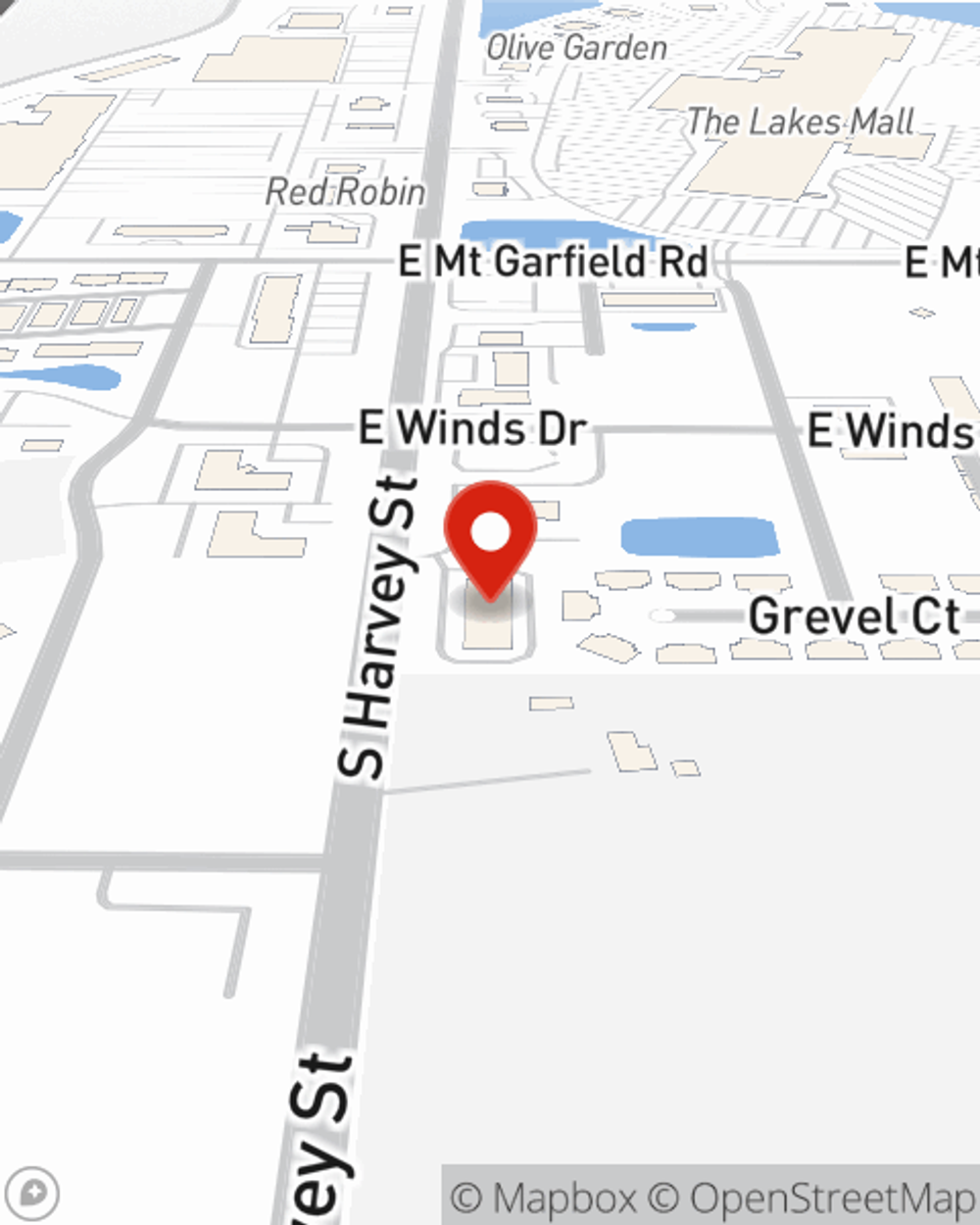

Condo Insurance in and around Muskegon

Looking for great condo unitowners insurance in Muskegon?

Condo insurance that helps you check all the boxes

- muskegon

- spring lake

- norton shores

- grand haven

- fruitport

- west olive

- allendale

- twin lake

- whitehall

- north muskegon

- montague

- rothbury

- coopersville

- roosevelt park

- ravenna

- fremont

- shelby

- ottawa county

- muskegon county

- oceana county

- hesperia

- kent county

- grand rapids

- holland

Home Is Where Your Heart Is

There are plenty of choices for condo unitowners insurance in Muskegon. Sorting through savings options and coverage options can be overwhelming. But if you want great priced condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Muskegon enjoy unmatched value and straightforward service by working with State Farm Agent Ben Vanbiesbrouck. That’s because Ben Vanbiesbrouck can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as home gadgets, videogame systems, linens, jewelry, and more!

Looking for great condo unitowners insurance in Muskegon?

Condo insurance that helps you check all the boxes

Agent Ben Vanbiesbrouck, At Your Service

When an ice storm, a blizzard or a hailstorm cause unexpected damage to your condo or someone hurts themselves on your property, having the right coverage is vital. That's why State Farm offers such great condo unitowners insurance.

Intrigued? Agent Ben Vanbiesbrouck can help you understand your options so you can choose the right level of coverage. Simply visit today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Ben at (231) 798-9846 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Ben Vanbiesbrouck

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.